19th February 2024

Essential Kit Every Remote Worker Needs in 2024

Remote working isn’t a new thing, but it has risen in popularity since the pandemic. Many businesses have embraced remote or hybrid working. This...

Read More >We have a great bakery in our part of town. We have a Greggs also – equally great, just different. In the former, I can buy a tremendous fruit loaf and their croissants are great too. But, for those who don’t live close to me, their choice is confined to Greggs. If I were to live in Brighton, it would be very different. We need more businesses in Newcastle to deliver jobs, GDP – and many more cakes.

Why can I taste the smell of bread, floating on the air in Brighton? It’s because there are more bakeries pumping their wares through the Sussex suburbs.

Put crudely, there are probably close to twice as many bakeries in Brighton as Newcastle. I’ve picked Brighton because the population is roughly the same size as that of Newcastle, even though it’s a seaside town and the business mix will be very different. If I abandoned population size as a constraint and stick with suburban places, then comparison with other South East locations suggests greater difference. For every one bakery in Newcastle, there will be 2.5 in Sevenoaks, Winchester and High Wycombe.

The chart shows how many businesses there are in Newcastle (per 10,000 people) by comparison with other cities. The differences are considerable.

There are 2 reasons why the number of businesses in a place is important.

It is a crude concept, but the reason that I cannot secure excellent patisserie across Newcastle is that there are too few bakeries. Therefore, there is little incentive to create scrumptious cakes. Or let me bring this closer to my own experience. (In spite of my example, I’m not a frequent consumer of cakes).

When we were developing The Racquets Court, we tried hard to place small contracts locally. These captured things like furniture, phones, internal switching gear and so on.

We failed.

There were usually three reasons or this. Firstly prices were too high and/or secondly, response times were too slow. Or, thirdly, our demands for particular style and quality were too onerous.

Contracts for switching gear and phones went to Leeds based businesses and furniture contracts went to London based businesses. Competition, particularly services competion, is not significant enough close to home, here in Newcastle.

The impact on innovation follows on from the impact on competition. In research for the then Scottish Development Agency, we found that firms in the South East took up innovation faster than firms in Scotland. We attributed this to the impact of firm density. It will always be the case that fewer people and businesses will mean less innovation, but this was something in addition. There is less incentive to take up new ways of doing things.

Business density has a partner in the business birth rate / business death rate.

Let us assume two hypothetical locations – ‘dense’ and ‘sparse’. Dense houses 200 businesses and Sparse houses 150. Both however have the same business birth rate of 10%. Next year, Dense will therefore house 220 businesses and Sparse will house 165.

What began as a business stock difference of 50, has grown to 55. The rich really do get richer, while the poor really do get poorer.

If low business density has an impact on competition and innovation, it follows that productivity will be lower also. We have to increase the number of businesses.

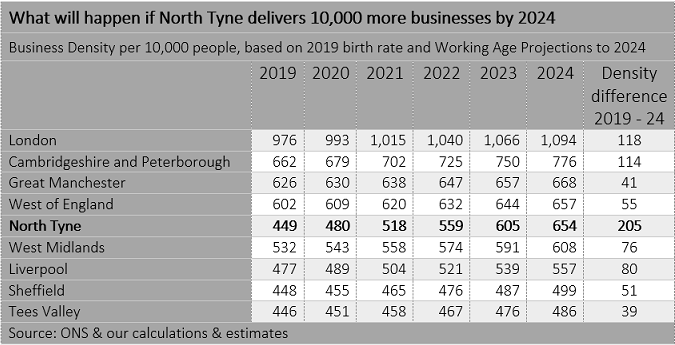

This is a ‘thought experiment’ that starts with 2019 data – but of course the principle applies if we were to start today.

Today, Newcastle has a business density of 432 businesses per 10,000 people. North Tyne (the area covered by the Mayor) has a business density of 449 per 10,000 people. The business birth rate across North Tyne varies between 11% and 15%. If birth rates stay the same until 2024, and we assume working age projections from ONS, then business density for North Tyne will increase to 502 businesses per 10,000 people.

This is shown in the Table.

But of course, everywhere else is changing also. The table shows how a stable business birth rate interacts with ONS projections for the working age population to 2024. The table indicates the degree to which, over this 5/6 year period, places will catch up with one another. For example, in North Tyne, we’ll have 53 more businesses per 10,000 people; Greater Manchester will have 41 more. So we’ll have caught up a bit with Manchester. But we will have lost our advantage over Liverpool because they will have 80 more businesses per 10,000 people in 2024 than they had in 2019.

More than this, the table emphasises the significant differences between the South East and everywhere else that I indicated at the beginning.

I have argued in an earlier post that we should not be picking winners. There are two reasons for this. Firstly, it’s too hard. Secondly, attempting to pick winners consumes a lot of resource. Advisers, bankers, financiers, all combining skills to deliver some kind of alchemy.

What we should do instead is let the market pick our winners.

We’d be better off throwing (I use the word advisedly) a ‘start and run a business’ education pack to anyone who wants to start a business. It doesn’t matter whether it’s a haidresser or a search engine to rival Google. More people running businesses means more role models for others to do the same; more businesses means more competiton; more competition means innovation; more businesses will enhance productivity. More productivity means greater GDP. And so on. This is the virtuous circle we need.

And let’s not forget how those 10,000 businesses to 2024 might be delivered. Firstly, it’s not 2,000 a year and secondly, the effort is distributed across four local authorities.

It is not 2,000 a year because it builds up – this is the virtuous circle effect. The final table below shows (a) how the effect accumulates over the years to 2024 and (b) how the heavy lifting would be distributed across local authorities.

Book Now

""

-

19th February 2024

Remote working isn’t a new thing, but it has risen in popularity since the pandemic. Many businesses have embraced remote or hybrid working. This...

Read More >6th February 2024

The Racquets Court, a leading provider of innovative coworking solutions, is thrilled to announce that it has been awarded the prestigious title of “Best...

Read More >To grow a business, someone has firstly to start one and then run one. Admittedly the same person does not have both to start a business and run it, but for the moment let us assume that this is one person and that her name is Olivia1The most popular girl’s name in Britain 2019. . Olivia is interested in starting and growing a tech business.

There are two sources which inform our understanding of this. After that, we can consider the impact of these things on new business creation.

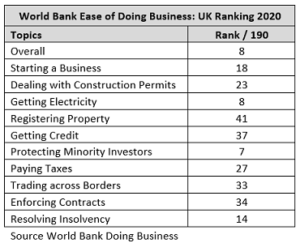

The 2 data sources that tell us about the environment for starting and running a business to grow it, are the World Bank Doing Business project and the Global Entrepreneurship Monitor project. The former offers a macro view, the latter a micro view.

Note that the variables that contribute to this overall rank cover a lot of ground. They include for example that, in some countries, it is very difficult to access electricity. Also, in some countries, Olivia would find it hard because she’s a woman.

For Olivia to grow her business, I suggest we need to look at an additional variable. I discuss that variable below.

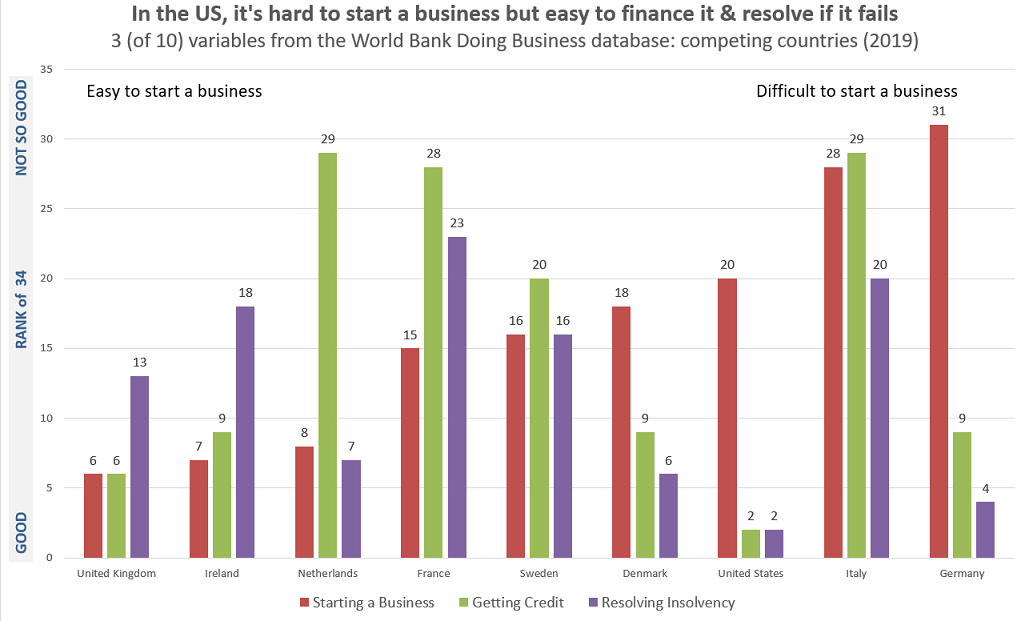

This chart shows these 3 variables for a number of competitor countries. The ranking here is different. The ranking here is based only on the 34 members of OECD, not all 190 countries in the full World Bank Doing Business Database.

The chart shows just how different is the US from these comparison countries. My interpretation is summed up in the chart headline. In the USA (to which we should aspire in terms of their ability to grow businesses), it is hard to start a business, but much easier to grow it by accessing credit, and much easier to close it, should it run into trouble.

Resolving insolvency easily is important. Things go wrong and when they do, they should be sorted out quickly. Speedy resolution means that key players can move on, learn from mistakes, and start again. Many have pointed out that, in the UK, there is a degree of shame being associated with a failed business, while in the US it is viewed as a learning experience, a stepping stone, a rite of passage. The ease with which insolvency is resolved in the US is an aspect of this.

Subtly, the fear of insolvency affects entrprepreneurs’ attitude to risk. Growing a business involves taking risks. While I do not believe that people take reckless risk, it is obvious that reducing the ‘costs’ of insolvency is likely to enhance attitude to risk.

Global Entrepreneurship Monitor has been reporting annually since 1999. The 2019 report covers 50 countries. Each country has its own research team and produces its own report to a global template and standard.

GEM has a measure called ‘Total Early Stage Entrpreneurship Activity’ (TEA) which is the combination of two measures. Measure 1 is ‘nascent entrepreneurs’.

These are individuals who commit resources, such as time or money, to starting a business. To qualify as a nascent entrepreneur, the business must not have been paying wages for more than three months. Measure 2 is ‘new business owner-managers’. These are businesses which have been paying income, such as salaries or drawings, for more than three, but not more than forty-two, months. More detail on the methodology can be found in the UK 2019 report.

TEA for the UK in 2019 was 9.9% which is close to half the US rate of 17.4%. Although I’m not a fan of spider diagrams, this one shows the key differences between the US and UK which go towards explaining this difference. A score closer to 10 is better.

A look at the variables suggest that there is little local economies can do in the UK to address these differences. However, there is one exception to this – a variable that can be addresssed locally. And a second over which a degree of influence is possible. These are the two variables to do with ‘entrpreneurial education’. One of these looks at entrepreneurial education in schools. The other looks at entrepreneurial education post school.

Recently, I have sat in on virtual meetings and also seen commentary on social media which refer to the ‘digital jobs market’ in Newcastle. Apparently, a large proportion of all advertised jobs are tech related. Also, I have heard many references to initiatives designed to enhance the ‘careers’ of young people in technology.

But enhancing her ‘career prospects’ in IT, is not what Olivia wants. She doesn’t want a career in IT. Olivia wants to start and grow an IT business. Olivia wants to offer careers in IT.

For Olivia, this is a problem. She knows (because she’s read the GEM Report on Britain), that entrepreneurial education is important, but she struggles to find it in Newcastle. Olivia has looked at the syllabuses at Newcastle schools including Newcastle’s University Technical College and has come away disappointed.

Olivia was particularly disheartened by two comments on the UTC why we’re different page.

One comment told Olivia that she’d be wearing ‘business attire’ – which is not the image Olivia has of a tech entrepreneur. The other comment told Olivia that she would be occupied during ‘9-5 working hours’. And again, this does not match the picture Olivia has of life as a tech entrepreneur.

So, based on real data comparing us with other countries, it is possible to identify things we can do to help Newcastle build more businesses and bigger businesses. However, it is important also to recognise that nothing we do will deliver results fast. Some of the things that the US does, and to which I referred in another post (like SBIR), have been in place for many years. The UK, having implemented SBIR badly, abandoned it. Policies like enhancing entrepreneurial education need commitment and review continuously.

It is possible for Newcastle to get great. It can only do that based on understaning its position in the world. That understanding is ONLY possible by analysing data.

Policies are no good unless they are monitored. What is our starting point? How does Newcastle’s business demography stack up and what might be sensible targets for say 5 years? I discuss this here.

Book Now

""

-

19th February 2024

Remote working isn’t a new thing, but it has risen in popularity since the pandemic. Many businesses have embraced remote or hybrid working. This...

Read More >6th February 2024

The Racquets Court, a leading provider of innovative coworking solutions, is thrilled to announce that it has been awarded the prestigious title of “Best...

Read More >Scaling up a small UK business is an issue. Many have referred to this. The chart shows it to be true. Growing a small business to be a medium one is difficult.

To address this, the UK has established the The Scale Up Institute. The mere establishment of this body lends weight to the problem and at the same time effectively downplays the importance of new business starts. In a piece in the Financial Times, John Mullins, an Associate Professor at London Business School is quoted saying:

“A common mistake is to focus on simply increasing the number of start-ups. Policy should instead be directed towards “scale-up” companies, many of which will already be trading but need to change their business model to find a more growth-oriented niche. Encouraging start-ups, given the churn that will inevitably occur among them, is the wrong place for government support. A wiser course would be to support growth in companies that are ready to scale up”

To which I would say:

Therefore, I don’t agree that this is an ‘either / or’ for Government policy. It’s both.

More than this, in arguing for us to direct support towards businesses that are ‘ready’ to scale up, we are lead to trying to pick winners. We first tried to pick winners for business support during Margaret Thatcher’s premiership. The UK returns to this theme regularly without any evidence that it is possible. It is true that the Scale Up Institute is saying that it is using AI to ‘pick winners’ so things may have changed. We will see.

All I would say is that in the USA, the most successful economy we seek to emulate, there are NO federal or State programmes that could be described as based on ‘picking winners’.

Therefore, start up and scale up are both important. How might we address deficincies in both?

The commentary around growing business is heavily focused on the failings of the firms themselves. Management is insufficiently skilled to grow the business. To remedy this, we have training and development programmes to ‘scale up’ small firms to large ones.

Of course it is possible that our entrepreneurs do lack the skills to grow businesses, although I am not sure how this could be established with certainty. However, the evidence does suggest that there is indeed an issue to do with ‘entrepreneurship education’ which I cover here.

There is an equally plausible explanation why the UK struggles to grow its small businesses by comparison with the US. This explanation is based on two things that distinguish the US and UK. Firstly, the US market is around 5.5 times that of the UK. This means not only that there are more people to sell to, but it also means that prices can be lower. The price advantage enjoyed in the US market can easily be extended to smaller, overseas markets creating a highly virtuous circle.

The business-to-business market is similarly distinguished.

The chart above does not capture firms with zero employees. In the UK, there are 4.6 million businesses with no employees. In the US, there are 24.8 million. Again 5.5 times as many. In total, (i.e. this number plus the numbers from the chart), there are 30.4 million businesses in the US; in the UK, there are 4.9 million.

This means that an SME developing business software has 30 million sales opportunities in the US and only 6 million in the UK. Pursuit of 0.1% of the business market in the US = 30,000 targets; in the UK = 6,000 targets. And so on.

This is a big deal. Speaking as someone who springs from a company that develops business software, I know that the US dominates almost every niche, with products that are cheaper than home grown examples. Having said that, I am intrigued that Australia and New Zealand seem to punch above their weight. Xero and Atlassian are examples.

Our membership of the EU should have addressed the market size issue. The EU market is even larger than that of the US. However, our 40 year membership of the EU has not obviously addressed the issue. This suggests the second of my speculative guesses about why the UK does not grow its small businesses. This is the British (losing) struggle with foreign languages. Not only does the US have 30 million business to business sales targets, those targets also all speak English. Selling to 0.1% of them in the US, delivers a financial platform to develop foreign language versions of whatever it is being sold. Yet another virtuous circle.

While I recognise that our membership of the EU single market may not have impacted the chart above, it is surely the case that exiting the single market will not have helped.

But for the moment, we have three possible explanations why the UK does not grow its small businesses: our entrepreneurs are not skilled enough, the UK market is not big enough and we expect our customers to speak English more than we should.

The first of these explanations, that our entrepreneurs are insufficiently skilled, is supported by the findings of the Global Entrpreneuship Monitor. They are particularly pertinent to Newcastle and the North East. This is discussed here.

Book Now

""

-

19th February 2024

Remote working isn’t a new thing, but it has risen in popularity since the pandemic. Many businesses have embraced remote or hybrid working. This...

Read More >6th February 2024

The Racquets Court, a leading provider of innovative coworking solutions, is thrilled to announce that it has been awarded the prestigious title of “Best...

Read More >When they are right, why are economists so easily ignored? Simon Wren Lewis, a macro-economist wrote a recent, good, blog on this. For those of us who have worked with regional economics, the problem is further complicated because the data is messy. But, ‘levelling up’ regional economies requires us to grapple with these difficulties, all the while remembering that we’ve been here before.

For example, not too long ago, most of us accepted that small firms create jobs and big firms lose them. That conclusion is now mediated by some who say that the quality of the created jobs is poor and low skilled. Or, that we do not need jobs in more firms, we need more jobs in fewer, high growth firms.

The latter is a very seductive argument for regional players. The PR that comes with association with a high growth business is attractive. And in a small regional economy (like that of Newcastle and its neighbours) it is easy for a very small number of growing business to assume significant status.

So do we need more firms? Or better firms?

In the North East, what are the features the regional economy that need ‘levelling up’ and what do we do to make it happen?

Along with others, I would argue that GDP is the key metric that would indicate that ‘levelling up’ has been succesful. If we achieve higher GDP, almost everything else follows. So what needs to happen to raise regional GDP?

In the period of the last Labour government, a lot of money slushed around to deliver regional growth. Agencies were created and research funded to answer what, at the time, appeared to be useful questions.

I think that a lot of that research was good, empirically robust and policy driven. Also, a significant number of good ideas were copied from the US.

However, the initiatives that flowed from the research were often badly implemented or non-existent. The project management was terrible.

Where ideas were copied from the US, there was little attempt to understand why they worked on the ground in America. What was it about the particular US environment that made them work?. 1Two initiatives which are examples of this are SBIR (the Small Business Innovation Research initiative) and BIDs (Business Improvement Districts). The former is long abandoned in the UK, but going strong still in the US; the latter is going both here and in the US, but rather more succesfully in the US. There is more detail about why these initiatives were poorly implemented in the UK here.

And at the end of this golden age of economic development initiatives, we’re still talking about the need to ‘level up’.

Unlike the ‘golden age’, the last decade has witnessed an almost complete absence of notable, centrally driven, regional economic research. Picking the golden nuggets from the golden age, I would argue for the following, ‘truths’ :

In this post and others which follow, I discuss these point with a focus on the North East with an attempt to use official data (ONS / NOMIS).

I am not reviewing the academic work on all of this. I hope I manage to inject a measure of ‘it’s obvious isn’t it’ without referencing the literature.

The research to see if what Birch had found in the US, applied in the UK, was funded by the Department of Education and undertaken by Trends Business Research (confession: this is a company which I founded). More recently, but still more than 10 years ago, the Department of Business (BEIS) commissioned a team at Aston University to look again – and the core finding that small firms create jobs, holds true.

When I first got involved with these findings, like many, I was initially surprised by them. Surely, big firms must turn in big job creation alongside big revenue. But a few moments reflection tells us that the finding is accurate. The news we read is of big firms delivering real, significant job losses and the number of small firms an any economy far outweighs the number of big ones. Common sense affirms the core finding. And although I am not reviewing the literature, I will say (because I know it to be true) that Trends Business Research went to the most enormous trouble to confirm the data.

This is not to say that other points about the quality of the jobs or the regional disparities or the sector distribution are not accurate. It is merely to say that job creation comes from small firms.

With that thought, the bigger question is why does the UK struggle to grow firms? What is the size of the problem? I discuss this in this post.

Book Now

""

-

19th February 2024

Remote working isn’t a new thing, but it has risen in popularity since the pandemic. Many businesses have embraced remote or hybrid working. This...

Read More >6th February 2024

The Racquets Court, a leading provider of innovative coworking solutions, is thrilled to announce that it has been awarded the prestigious title of “Best...

Read More >